Project Duration

9 Months

Services Provided

Ideation and Concept Development | Stakeholder Engagement | UX Flow and Information Architecture | App and Tablet responsive Design | Visual Design and White-labelling | Prototyping

Background

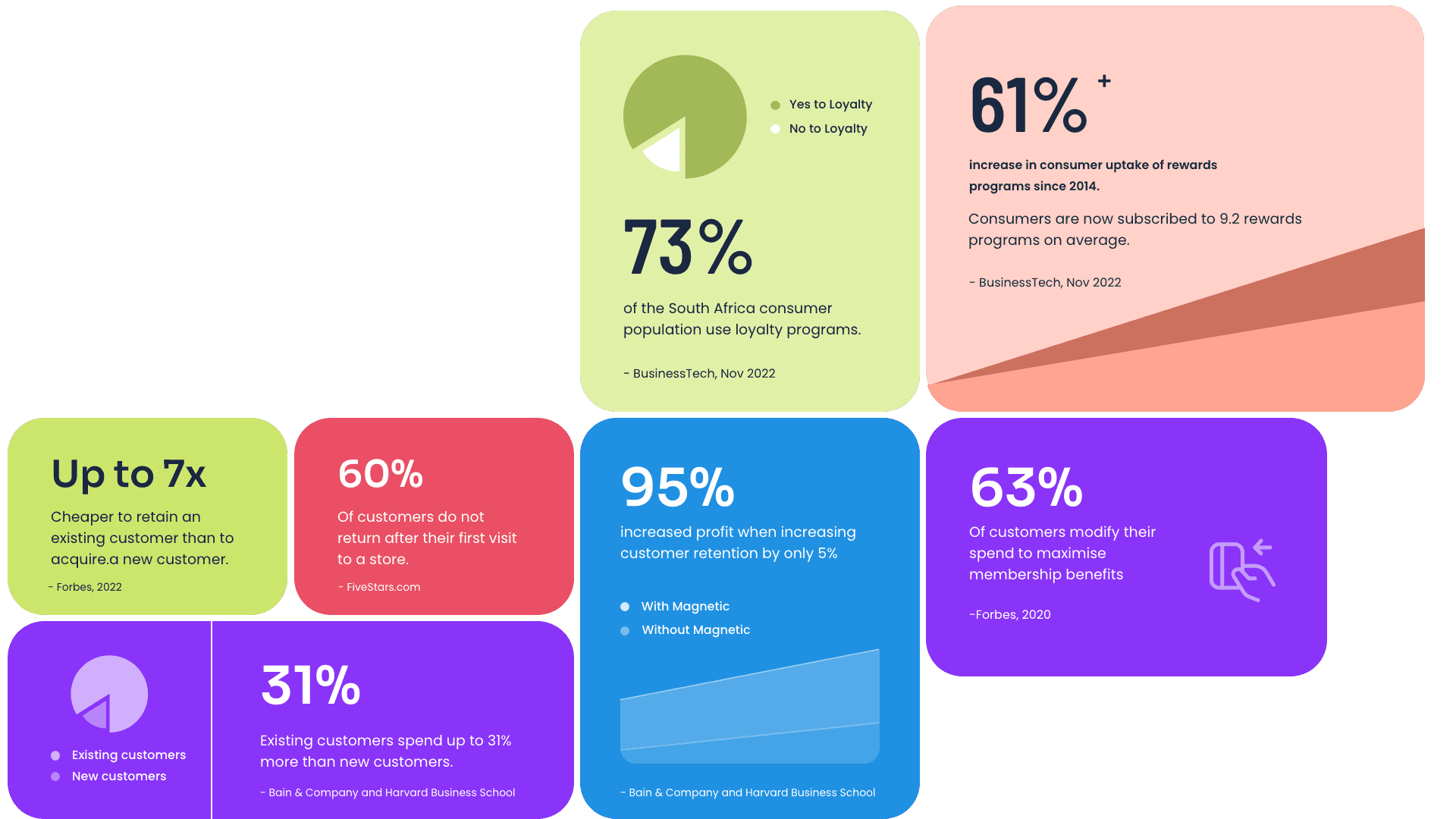

Magnetic is designed to help small merchants attract and retain more customers by providing access to affordable business tools previously available only to large enterprises. By offering a suite of solutions alongside payment services, Magnetic enhances product differentiation and improves merchant retention. Merchants using Magnetic receive a full starter kit that addresses their core needs and facilitates growth.

Development and Design Collaboration

During my time working on Magnetic, I led the design efforts and covered various aspects and considerations for developing a new product from the ground up. This involved extensive project planning, stakeholder engagement, competitive analysis, ideation, research, UX flow development, design, prototyping, and testing.

Business Insights

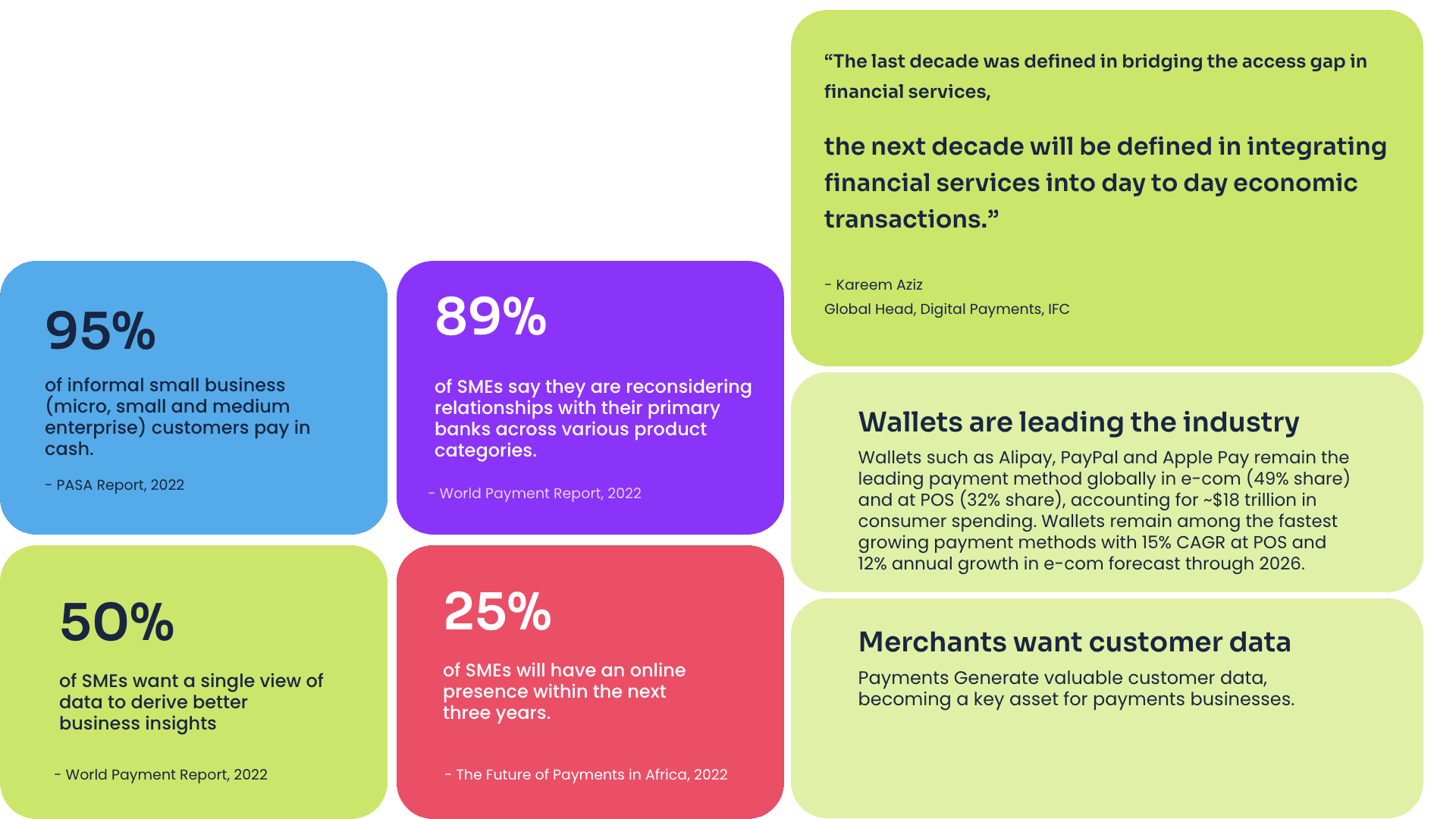

The shift from cash to card and digital payment methods presents a significant challenge for small merchants, who often find business applications too complex and expensive to implement. This complexity leads to difficulties in providing a seamless customer experience and attracting loyal customers without personalised marketing and rewards programmes. In South Africa's competitive payment industry, where companies compete primarily on rates, Magnetic offers an all-in-one solution that reduces merchant churn and strengthens market position.

Challenges and Solutions

Complex and Expensive Implementation: Small merchants often struggle with the complexity and cost of implementing business applications. We designed Magnetic to be an affordable, all-in-one solution that simplifies these processes, making it accessible to small merchants.

Lack of Personalised Marketing: Attracting loyal customers is challenging without personalised marketing and rewards programmes. Magnetic includes tools for personalised marketing and rewards, helping merchants retain customers.

High Merchant Churn: Payment companies in South Africa compete on rates, leading to high merchant churn. Magnetic's comprehensive solution reduces the likelihood of merchants switching partners for better rates, fostering long-term relationships.